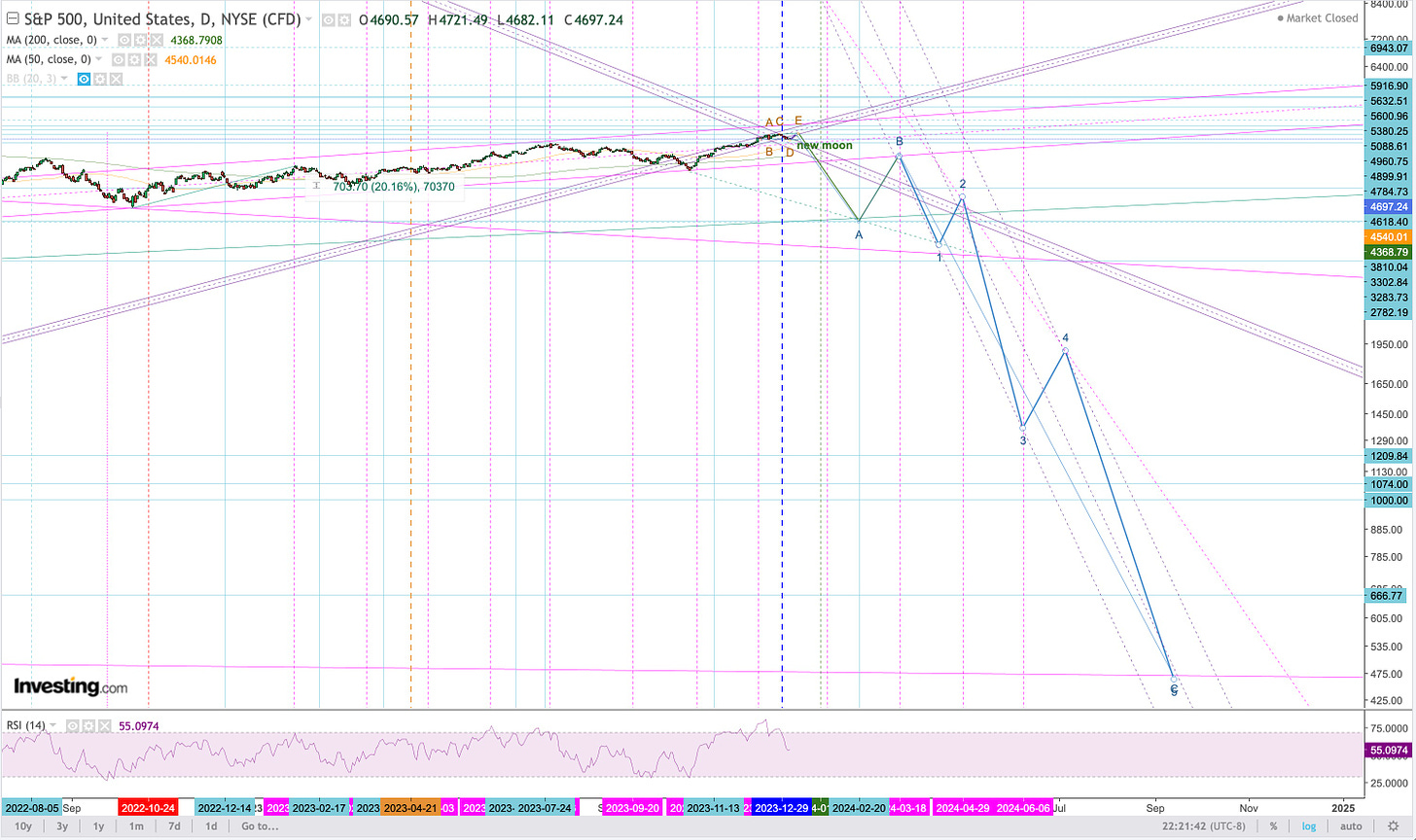

Thursday? We’re into what looks like a very-bearish megaphone top that I would like to see finish up late this week — Thursday at the open would be ideal. We have CPI and PPI data, as well as employment numbers, out Thursday and Friday. Once the S&P 500 tags a new high, the machines will be free to flip a bit and sell again.

If we get that final high, I’m pricing index puts on the 2/23 expiry, with a sharp drop to the support provided by the last-ditch trendline up from the 666 lows. This will then give enough time for optimism and desperation to bounce us into the March FOMC.

March and May FOMCs disappoint, June and September mark lows. We get an historic 90%+ collapse of equity markets. This will save the banks in the short term, as Treasury debt is bid as a flight to safety. Also expecting political events to heat up over the summer as the illegitimate “Joe Biden” junta is exposed and deposed.

The Treasury complex implodes later on, once the COVID-19 vaccine deaths surpass 100 million in the United States. Bonds implode and take cash (zero-coupon Treasuries) with it, a crucial step in the Great Reset. We will then rebuild the future system with honest money instead of usury.

Nothing can stop what is coming, it is all necessary to clear the decks and move ahead.

NOT INVESTMENT ADVICE YOU MOOKS

All content on this site is for informational purposes of a general nature only, and does not address any circumstances of any particular individual or entity. Do not construe any such information or material as legal, tax, investment, financial, professional or any other advice. Content on our site does not represent or constitute any solicitation, inducement, recommendation, endorsement or offer by Unvaccinated or any third party service provider to buy or sell securities, commodities, digital assets or any financial instruments. Nothing on our sites constitutes professional and/or financial advice, nor does any information found on this site constitute a comprehensive or complete statement of the matters discussed. Unvaccinated is not a fiduciary by virtue of any person's use of or access to this site and content. Any information, materials, statements and/or data set out herein is subject to change anytime without notice and as such, no reliance must be placed on fairness, accuracy, completeness or correctness of any information and materials contained on this site.

What a surge! We're actually tracking to make new highs now as early as Wednesday morning, if we maintain this pace.

Definitely on board with thinking rates won't be lowered any time soon.